RESERVE BANK OF INDIA (RBI) has recently taken strict actions against PAYTM PAYMENTS BANK LIMITED (PPBL) under Section 35A of the Banking Regulation Act, 1949. Here, its mentioned about the reasons due to which RBI took this action, directions to PPBL and its impact on the customers.

Main Issue of Paytm Payments Bank and RBI

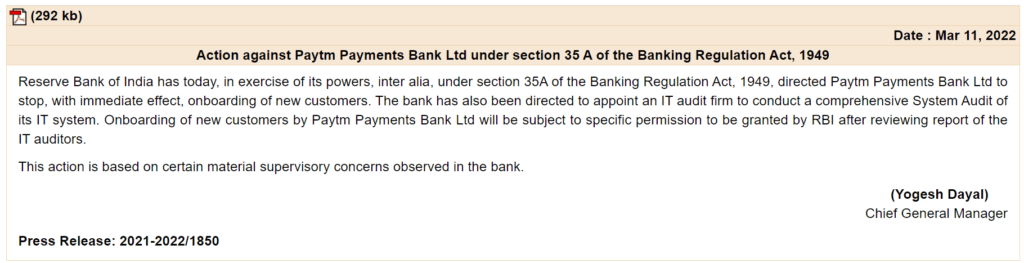

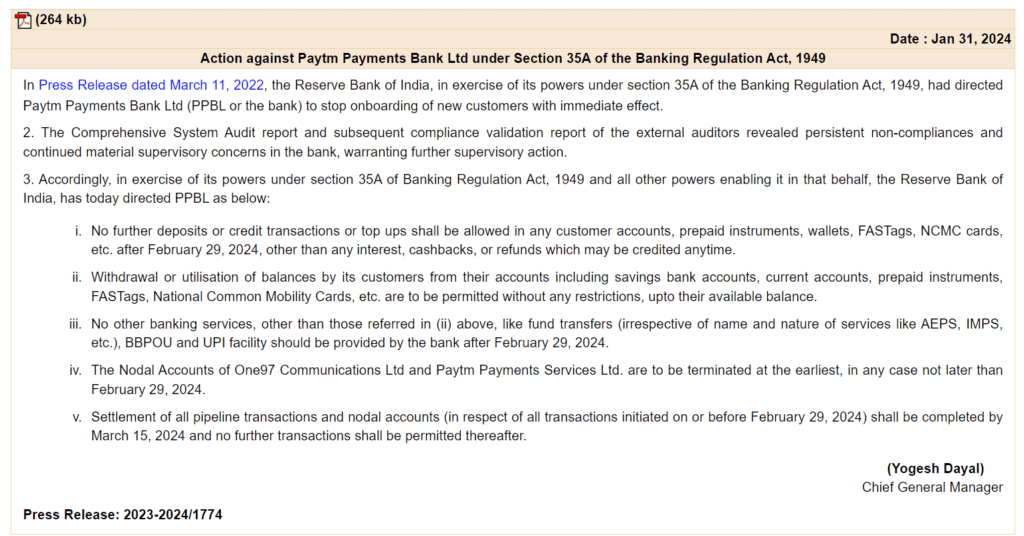

On March 11, 2022, the RBI issued a press release instructing Paytm Payments Bank to halt the enrollment of new customers right away under section 35A of the Banking Regulation Act, 1949. RBI also directed the bank to appoint an IT audit firm to conduct a comprehensive System Audit of its IT system. But it seems that the bank did not took it seriously and took no action, completely ignoring the guidelines of the Reserve Bank of India.

Directions to the Paytm Payments Bank by RBI

Now, again taking this issue into consideration, Reserve Bank of India has issued another press release on January 31, 2024. In this press release, Reserve Bank of India (RBI) took strict actions and directed the Paytm Payments Bank Limited (PPBL) as follows:

- After February 29, 2024, no further deposits or credit transactions or top ups shall be allowed in any customer accounts, prepaid instruments, wallets, FASTags, NCMC cards, etc.

- No other banking services, other than fund transfers (irrespective of name and nature of services like AEPS, IMPS, etc.), BBPOU and UPI facility should be provided by the bank after February 29, 2024.

- The Bank have to terminate The Nodal Accounts of One97 Communications Ltd and Paytm Payments Services Ltd. at the earliest, in any case not later than February 29, 2024.

- Settlement of all pipeline transactions and nodal accounts (in respect of all transactions initiated on or before February 29, 2024) shall be completed by March 15, 2024, and no further transactions shall be permitted thereafter by the bank.

Impact On Customers

- The customers can withdraw their money from the account any time. Even if there is restrictions on the bank for the further deposits or credit transactions, wallets, FASTags, NCMC cards, etc. after February 29, 2024, but still any remaining interest, cashbacks, or refunds can be credited anytime to the customer’s account.

- Along with this, Withdrawal or utilization of balances by the customers from their accounts including savings bank accounts, current accounts, prepaid instruments, FASTags, National Common Mobility Cards, etc. are to be permitted without any restrictions, up to their available balance.

So, as of now, there is no impact of it on the existing customers as they can get their remaining interests, cashbacks and credits anytime and can even withdraw or utilize the remaining balance without any restrictions.